Yearly depreciation formula

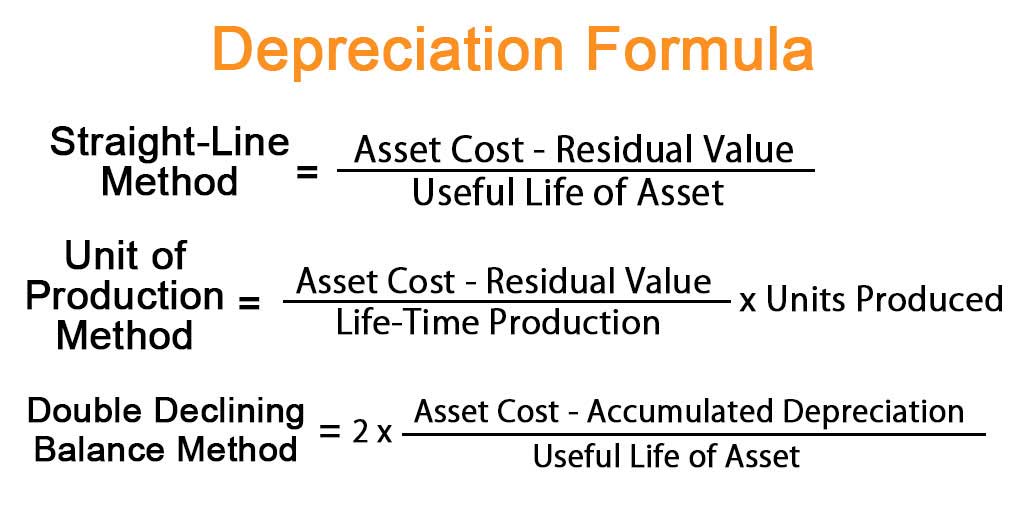

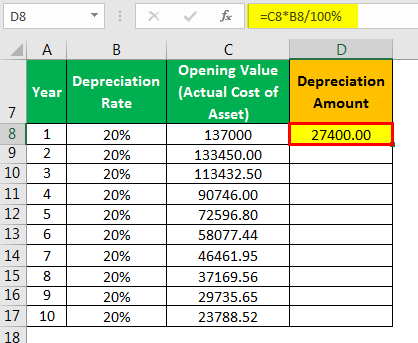

Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Depreciation per year Book value Depreciation rate.

Declining Balance Depreciation Double Entry Bookkeeping

If you enter a fixed yearly percentage application uses the following formula to calculate the depreciation amount.

. For an asset with a five-year useful life you would use 15 as the denominator 1 2 3 4 5. Depreciation Amount Straight-Line x Depreciable Basis. The numerator of the fraction is the current years net income.

Depreciation Per Year is calculated using the below formula Depreciation Per Year Cost of Asset Salvage Value Useful Life of Asset Depreciation to be charged each year 5000000. You then find the year-one. The DDB rate of depreciation is twice the straight-line method.

Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. Under the income forecast method each years depreciation deduction is equal to the cost of the property multiplied by a fraction. In the first year multiply the assets cost basis by 515 to find the annual.

For every full year that a property is in service you would depreciate an equal amount. The straight-line method is the primary method for. 3636 each year as long as you continue to depreciate the property.

Annual Depreciation 10000-10005. Annual depreciation purchase price - salvage value useful life According to straight-line depreciation this is how much depreciation you have to subtract from the value of. Annual Depreciation Cost of Asset Net Scrap ValueUseful Life.

In year one you multiply the cost or beginning book value by 50. Ad Confidently Tackle the Most Complex Tax Planning Scenarios Year-Round. 1800year Annual Depreciation Rate Annual.

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Rate Formula Examples How To Calculate

Double Declining Balance Method Of Depreciation Accounting Corner

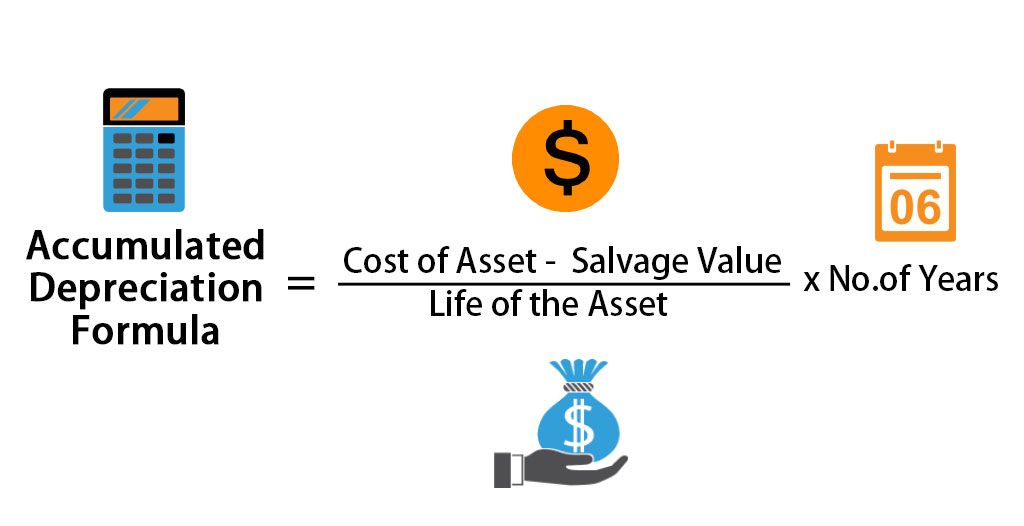

Accumulated Depreciation Definition Formula Calculation

What Is Accumulated Depreciation How It Works And Why You Need It

A Complete Guide To Residual Value

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Expense Calculator Best Sale 57 Off Www Ingeniovirtual Com

Depreciation Calculation

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Rate Formula Examples How To Calculate

Straight Line Depreciation Formula Guide To Calculate Depreciation

Straight Line Depreciation Formula And Calculation Excel Template

Ex Find Annual Depreciation Rate Given F T Ae Kt Youtube

Exercise 6 5 Compound Depreciation Year 10 Mathematics

Macrs Depreciation Calculator With Formula Nerd Counter